IE NEW YORK COLLEGE RECORD RETENTION POLICY

1. Purpose

To outline the policy for the retention and disposal of information and records held in any format by IENYC (“the College”).

2. Policy Statement

Certain organizational documents and electronic files are required by law to be kept for a minimum length of time because of their importance as operational, legal or financial records. A record may include items such as a memorandum, a contract, an e- mail, or a report, as well as other less obvious items, such as a computerized desk calendar, an appointment book, or an expense record. Records may be in any medium, including print, electronic, and audio/visual media.

The Records Retention Policy sets out the timescales for retaining records and the disposal action which may be destruction or long term preservation (archiving). Below are tables of Permanent and Non-Permanent Records with Retention Periods. Exceptions to these rules and terms for retention may be granted only by the President & CEO or such person as nominated by the President & CEO for this purpose.

Procedures will be put in place to review records to identify those which may be destroyed in line with the Records Retention Policy. This will ensure that information is not retained for longer than required to meet business needs and legal and regulatory requirements.

Records may be designated as being of enduring or long term value and suitable for permanent retention and maintenance in the College Archives. These will be identified in the Records Retention Policy.

Procedures will be implemented to prevent the premature destruction of records that need to be retained to satisfy legal, financial and other requirements of public administration.

Staff will ensure that where certain records are relevant to litigation or potential litigation, that is a dispute that could result in litigation, then those records will be preserved until the organization’s attorneys determine the records are no longer needed. This exception supersedes any established destruction schedule for those records.

The record owner will approve disposal and a record will be kept of the authorising officer and date of authorisation.

Information and records held in any format will be destroyed in a secureand permanent manner which renders the recovery or recreation of the informational content impossible.

A Destruction Certificate will be received and retained to audit off-site destruction.

3.Retention Schedule

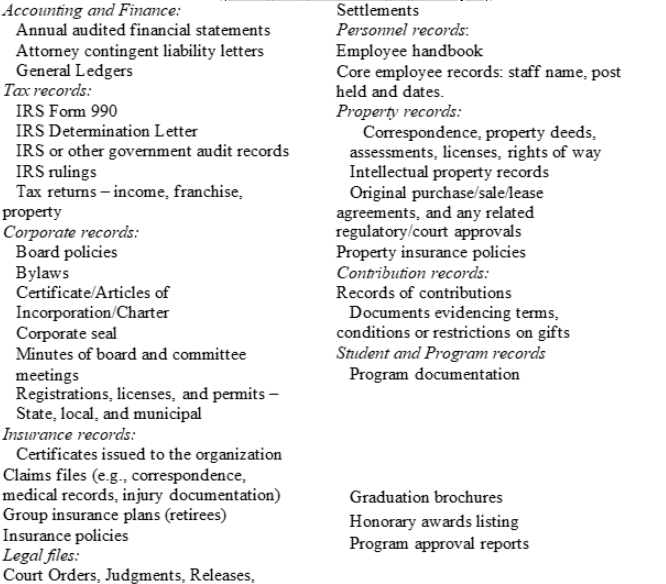

Permanent Records (Items that should not be destroyed)

Non-Permanent Records

Section Topics

- Accounting and Finance

Tax Records

Corporate Records

Contracts

Grant Records

Insurance Records

Legal Files

Personnel Records

Payroll Records

Property Records

Contribution Records

Correspondence and Internal Memoranda

Electronic Documents

Student Records

Program Records

Research Records

Library Records

- Accounting and Finance

Record Type | Retention Period |

Accounts Payable ledgers and schedules | 7 years |

Accounts Receivable ledgers and schedules | 7 years |

Annual audited financial statements | Permanent |

Attorney contingent liability letters | Permanent |

Bank Statements, cancelled checks, deposit receipts | 7 years |

Budgets (annual) | 2 years |

Cash journals, check registers | 7 years |

Credit card statements | 2 years |

Employee expense reports | 7 years |

General Ledgers | Permanent |

Investment records | 7 years after sale of investment |

Invoices | 7 years |

Loans/Notes Payable ledgers and schedules | 7 years |

Petty cash records | 7 years |

Purchase orders | 7 years |

Tax Records

Record Type

Retention Period

Excise tax records

7 years

Federal and state annual information returns (e.g., Form 990)

Permanent

IRS Determination Letter

Permanent

IRS or other government audit records

Permanent

IRS rulings

Permanent

Payroll tax records

7 years

Sales/use tax records

7 years

Tax bills, receipts, statements | 7 years |

Tax returns – income, franchise, property | Permanent |

Tax workpaper packages | 7 years after completion of audit |

Corporate Records

Record Type | Retention Period |

Board policies | Permanent |

Bylaws | Permanent |

Certificate/Articles of Incorporation/Charter | Permanent |

Corporate seal | Permanent |

Minutes of board and committee meetings | Permanent |

Registrations, licenses, and permits - state, local, and municipal (e.g., foreign “doing business as” registrations, d/b/as, charitable state registrations) | Permanent |

Contracts

Record Type | Retention Period |

Contracts and related correspondence (including any proposal that resulted in the contract and all other supporting documentation) | 17 years after expiration, termination, and/or non-renewal |

Loan and related Security Agreement records | Duration of the term of the loan, plus the minimum statute of limitations period after the loan is fully discharged |

Grant Records

Record Type | Retention Period |

All evidence of returned funds | 7 years after end of grant period |

All pertinent formal correspondence, including opinion letters of counsel | 7 years after end of grant period |

All requested IRS/grantee correspondence including grantee’s IRS determination letters | 7 years after end of grant period |

Final grantee reports (financial and narrative) | 7 years after end of grant period |

Grant agreement | 7 years after end of grant period |

Original grant proposal | 7 years after end of grant period |

Insurance Records

Record Type | Retention Period |

Annual loss summaries | 10 years |

Audits and adjustments | 3 years after final adjustments |

Certificates issued to the organization | Permanent |

Claims files (e.g., correspondence, medical records, injury documentation, etc.) | Permanent |

Group insurance plans (active employees) | Until plan is amended or terminated |

Group insurance plans (retirees) | Permanent or until 6� years after death of last eligible participant |

Incident and Accident Reports | 4 years after report date |

Insurance policies | Permanent |

Releases and settlements | 25 years |

Workers’ compensation claims and insurance policies | 18 years |

Health and Safety awareness records (eg Risk Assessments, fire warden training) | 10 years |

Legal Files

Record Type | Retention Period |

Court Orders | Permanent |

Judgments | Permanent |

Legal memoranda and opinions | 7 years after close of the matter |

Litigation files | 5 years after case is closed and expiration of time for appeals |

Lobbying records – state and federal lobbying expenses, reports, and supporting records | 10 years |

Releases | Permanent |

Settlements | Permanent |

Retention Schedule | 10 years after superseded |

Personnel Records

Record Type | Retention Period |

Americans with Disabilities Act (ADA) requests or claims | 2 years; if charge filed, until resolved |

Awards/Bonuses/Incentives | 7 years |

EEO-1, EEO-2 Employer Information Reports to the EEOC | 2 years after superseded or filing (whichever is longer) |

Employee earnings records | Separation + 7 years |

Employee handbook | Permanent |

Employee medical records in general

*Note that medical records must be stored separately and treated as confidential, except in the case of providing information to supervisors concerning accommodations. | Separation + 30 years

Exception is for employees who worked for less than one year as long as they are given records upon termination. |

Logs and summaries of occupational injuries or illnesses | 5 years |

Any ADA requests or claims | 2 years; if charge filed, until resolved |

Employee personnel records (hired): including resume/application form, Form I- 9, individual attendance records, job or status change records, compensation information, performance evaluations, disciplinary matters, termination papers, leave/comp time/FMLA, employee benefit plan enrollment, hiring/termination dates, engagement and discharge correspondence, worker’s compensation claims, withholding information, garnishments, test results, training and qualification records

*Note that payroll records, including dates of leave, records of any disputes must be stored separately and treated as confidential. | Separation + 6 years |

Employment contracts (individual) | Separation + 7 years |

Employment records (hired): correspondence with employment agencies and advertisements for job openings | Date of hiring decision + 3 years |

Employment records (non-hired applicants): applications and resumes, results of post-offer, pre-employment physicals, results of background investigations if any, related correspondence | 2 years (4 years if file contains any correspondence that might be construed as an offer) |

Job descriptions | 3 years after superseded |

Occupational injuries or illnesses - logs and summaries | 5 years |

Sexual harassment complaints, investigations, and findings | No-Cause Findings, 3 years from determination Cause Findings, Permanent |

Payroll Records

Record Type | Retention Period |

Employee deduction authorizations | Termination + 4 years |

Garnishments, assignments, attachments | Termination + 7 years |

Payroll deductions | Termination + 7 years |

Payroll registers (gross and net) | 7 years |

Time cards/sheets | 2 years |

Unclaimed wage records | 6 years |

W-2 and W-4 forms | Termination + 7 years |

Property Records

Record Type | Retention Period |

Correspondence, property deeds, assessments, licenses, rights of way | Permanent |

Intellectual property records (trademarks and service marks, copyrights, patents) | Permanent |

Original purchase/sale/lease agreements, and any related regulatory/court approvals | Permanent |

Property insurance policies | Permanent |

Contribution Records

Record Type | Retention Period |

Records of contributions | Permanent |

Documents evidencing terms, conditions or restrictions on gifts | Permanent |

Fund raising and donations | 6 years |

Correspondence and Internal Memoranda

General Principle: Correspondence and internal memoranda should be retained for the same period as the document they pertain to or support. For example, a letter pertaining to a particular contract would be retained as long as the contract (see Contracts section). Records that support a particular project should be kept with the project and take on the retention period of that particular project file.

Correspondence and memoranda that do not pertain to documents having a prescribed retention period should generally be discarded sooner. These may be divided into two general categories:

Routine matters having no significant, lasting consequences: Discard within two years. Examples include:

Routine letters that require no acknowledgment or follow-up, e.g., notes of appreciation, letters of transmittal, plans for meetings

Form letters that require no follow-up

Letters of general inquiry and replies that complete a cycle of correspondence

Letters of complaints or requesting specific action that have no value after changes are made or action is taken (e.g., name/address change)

Documents pertaining to non-routine matters or having significant lasting consequences should be retained permanently, unless otherwise determined by the Executive Director, President or legal counsel.

Copies of interoffice correspondence should be maintained in the originating department file only.

Electronic Documents

1. Electronic Mail: Not all email needs to be retained, depending on the subject matter.

- All e-mail—from internal or external sources—is to be deleted after 12 months.

- Staff will strive to keep all but an insignificant minority of their e- mail related to business issues.

The organization will archive e-mail for six months after the staff has deleted it, after which time the e-mail will be permanently deleted.

All business-related email should be downloaded to a user directory on the server.

Staff will only store or transfer organization-related e-mail in accordance with the College’s Information Classification Policy.

Staff will only send confidential/proprietary information in accordance with the College’s Information Classification Policy.

Any e - mail staff deems vital to the performance of their job should be stored on the network drives rather than employee personal drives.

Electronic Documents: (e.g., PDF, Word, Excel, image files) The retention period for electronic documents is based on the subject matter and its respective category under this Policy.

Web Page Files: Internet Cookies

The Web browsers on all workstations should be scheduled to delete Internet cookies once per month.

In certain cases, a document will be maintained in both paper and electronic form. In such cases, the official document will be the electronic document.

Student Records

Record Type | Retention Period |

Admissions Successful | 6 years |

Admissions Unsuccessful | 1 year |

Exam results | 80 years |

Graduation brochures | Permanent |

Graduation registration | 1 year |

Attendance records | 6 years from end of relationship |

Absence | 6 years from end of relationship |

Student file | 6 years from end of relationship |

Exam papers (ie question papers) | 6 years |

Exam scripts (ie student exam papers) | 2 years |

Courseworks (ie assignments, student papers) | 2 years |

Plagiarism records | 5 years |

Appeals Records | 5 years |

Disciplinary Committee records | 5 years |

Visa and immigration records | 6 years from end of relationship |

Disclosure/Police check (certificates, details) | 6 months |

Disclosure/Police checks (summary details) | 6 years from end of relationship |

Alumni records | Permanent |

Student returns (eg to statutory bodies) | 5 years |

Student funding (eg hardship) | 6 years from end of relationship |

FERPA forms | 6 years from end of relationship |

Honorary awards record | Permanent |

Program Records

Record Type | Retention Period |

Approval and review reports | Permanent |

Program documentation/specification | Permanent |

External examiner approvals ?? | 5 years from termination |

External examiner reports (overall) ?? | Permanent |

Annual Monitoring reports | 5 years |

Module feedback forms | 5 years |

Professional/Statutory Body reports | Permanent |

Student Staff Consultative Group minutes | 5 years |

Program Board minutes | 5 years |

Program business case | Permanently (within Committee papers) |

Library Records

Record Type | Retention Period |

Library user records | 1 year from end of relationship |

4.Training & Awareness

All staff will be made aware of this Policy as part of the induction process. The Policy will be published on the GCNYC website and any amendments or revisions will be noted within the document control section.

5.Policy Review

A review will be undertaken on an annual basis with content being updated as appropriate. It may be altered at any time if amendments are deemed necessary.